Amazon Branding Survey : What are the Direct Branding Limitations for Amazon sellers?

We’re discussing Amazon a lot because as both an eCommerce Retailer and an eCommerce Marketplace, Amazon has captured, satisfied and converted so many consumers during the pandemic. Other retailers are now faced with the dilemma of considering whether to join as a seller and compete within the ecosystem of Amazon’s marketplace or to look at alternatives available external to the platform.

We conducted an online survey to explore the limitations of operating as a seller within the Amazon marketplace and wanted to share our findings with you, which we’ve summarised below.

The Survey

The 35 survey participants were anonymous. Most (71%) were Millennials and mostly (81%) based in Western Europe. Of the total respondents, 81% have an Amazon Prime account, and 83% said they use Amazon for shopping.

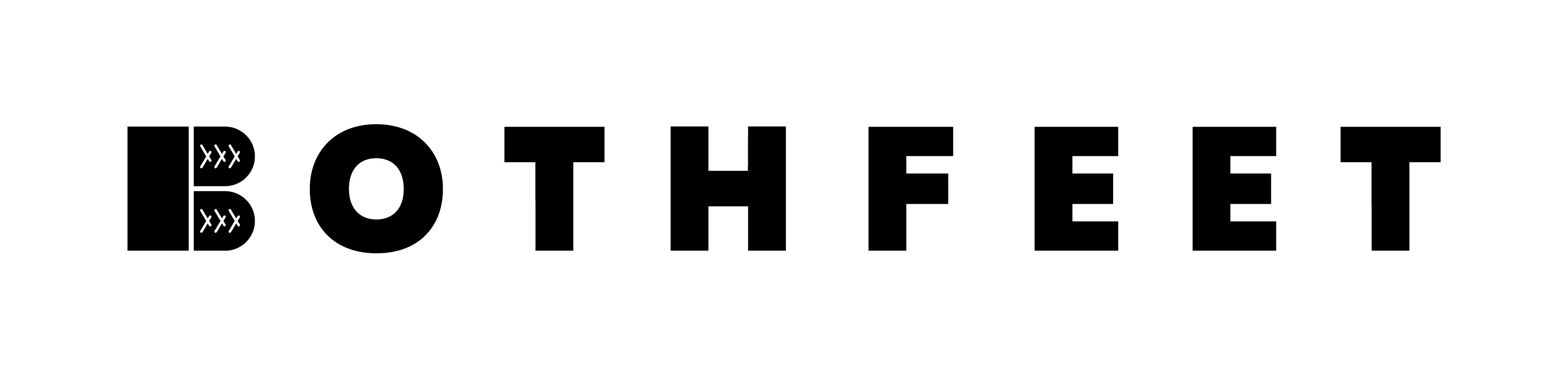

“67% of consumers are very likely to continue to use Amazon to the same extent post-Covid-19”.

48% of those who answered “very likely” had also responded to an earlier question stating that they use Amazon more now than before the COVID-19 outbreak. The shopping restrictions brought by the pandemic changed online purchasing behaviour resulting in brick-and-mortar customers converting into loyal online Amazon customers.

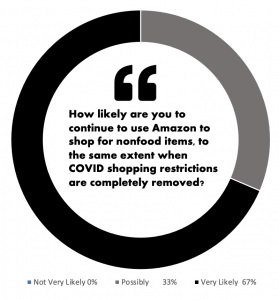

“57% of consumers used Amazon frequently prior to the pandemic.”

However, when asked how often they used the Amazon platform for shopping before the COVID-19 outbreak, 57% of total respondents say they frequently used Amazon already, suggesting that the Amazon brand had already achieved preferred brand status before the pandemic.

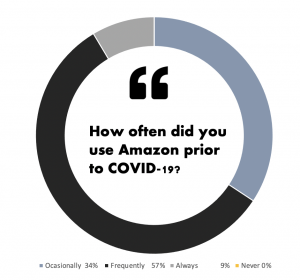

“46% of respondents aren’t able to recall the name of the last 3 brands purchased through Amazon.”

We also tested brand recall of products purchased through the Amazon platform. Respondents were asked if they could recall the product brand name of the last three items purchased through Amazon. The question was a direct, single answer ‘yes or no’ format, where 60% of respondents claimed they could. We then asked an open question for respondents to reinforce this claim by asking them to type into the box, the brand name of the last three items purchased.

The results show that 46% of respondents weren’t able to recall the brand name of any products purchased through Amazon, 20% of the respondents were able to remember and list the brand name of the last item purchased, and 8% were able to recall the brand name of the previous two products bought. Just 26% of the respondents could remember and list the brand name of the last three products purchased through Amazon.

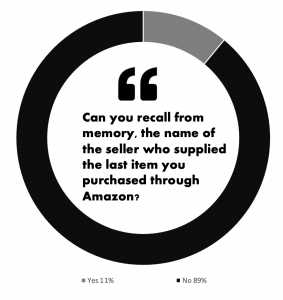

“89% of consumers can’t recall the seller of the last item purchased through Amazon.”

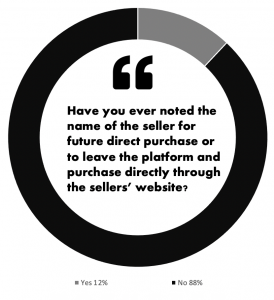

“88% of participants have never noted the name of the seller for future or direct purchase.”

The above questions were intended to test both the brand equity and customer acquisition potential for the retailer selling within the Amazon platform. An astonishing 89% of respondents weren’t able to recall the name of the seller of the last item purchased through the platform, and 88% of participants have never noted the seller’s name for future direct purchase or to leave the platform and purchase directly through the platform sellers’ website.

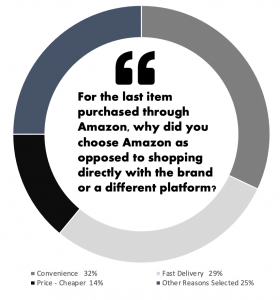

“Convenience and fast delivery are the top reasons for customers choosing Amazon.”

Among participants, convenience is the most important factor and was chosen in 32% of responses, shortly followed by ‘fast delivery’, which accounted for 29% of responses.

Summary

Overall, the findings from this survey show that before the pandemic, Amazon had already achieved strong brand preference and customer loyalty. However, the survey highlights that consumers do use Amazon more since the COVID-19 outbreak. The circumstances brought on by the pandemic have led to altered shopping behaviour, which has transitioned the consumer from an offline to an online preferred environment. The survey highlights that Amazon is the brand of consumer choice due to the convenience of the site (more manageable payment and speed of checkout process), fast delivery and price competitiveness within the platform.

Based on the consumer online shopping experience offered by the Amazon platform, the brand that remains in the mind of the consumer, and ultimately the brand that is recalled at the point of re-purchase is the Amazon brand and not the brand of the retailer selling through the marketplace, nor the product brand.

The study highlights the importance of eCommerce retailers not relying solely on online marketplaces. It also emphasises the importance of building additional direct brand awareness and online customer experience through the eCommerce website.

The priority of Amazon has always been the customer, and to succeed, e-commerce retailers must mirror the user experience offered by retailers such as Amazon as opposed to falling under the complete control of the Amazon marketplace. Whilst there are benefits to utilising the platform to generate sales, branding external to the online marketplace platform is essential. Organisations are now seeking new and innovative ways of keeping the customer on their website for first and repeat purchases.